Before RAW Cones became a staple for smokers around the world, cones and rolling papers occupied very different roles in smoking culture. Rolling papers were common, but rolling itself was a learned skill—one that came with frustration, inconsistency, and wasted material. Cones existed only on the margins, more idea than industry. What RAW ultimately did was connect these two worlds, transforming cones and rolling papers from functional tools into something more intentional, accessible, and widely adopted.

This article explores the full history of cones and rolling papers, and how RAW helped redefine both.

Rolling Papers Before RAW: A Culture Built on Skill

Rolling papers have existed for centuries, but for most of modern history they were designed with tobacco in mind. By the twentieth century, the rolling paper industry was dominated by bleached, heavily processed papers engineered for visual uniformity rather than flavor or burn quality. For cannabis smokers, this often meant harsh smoke and muted taste, an accepted compromise simply because alternatives were rare.

Rolling was inseparable from the experience. If you wanted a joint, you had to roll it yourself or know someone who could. The act carried a certain prestige, but it also created barriers. Beginners struggled. Group sessions depended on one or two “good rollers.” Poor rolls burned unevenly and wasted material, yet these flaws were normalized as part of smoking culture.

Rolling papers were everywhere, but the experience they delivered was inconsistent by design.

Early Cones: An Old Idea Without a System

The cone shape itself predates modern rolling papers. Hand-rolled cones appeared as early as the mid-1800s, used by pharmacists and workers who needed a fast, efficient way to prepare a smoke. In the 1920s, cones gained popularity in nightlife and jazz scenes because they could be rolled ahead of time and shared easily.

Despite this long history, cones remained informal and unstandardized. They were something you made, not something you bought. Rolling papers still required skill, and cones were simply one more technique rather than a product category.

That began to change in the 1990s, when MountainHigh introduced the first mass-produced pre-rolled cones for Amsterdam coffee shops. These early cones solved a practical problem (saving time) but they didn’t redefine cones and rolling papers as materials. The paper quality was largely unchanged, and outside of Europe, cones remained niche.

Convenience existed, but intention was still missing.

The Problem with Traditional Rolling Papers

By the early 2000s, cones and rolling papers were treated as commodities. White, bleached papers became the standard, achieved through chemical processes that left traces of chlorine, heavy metals, and additives in the paper. Most smokers didn’t question what their rolling papers were made from because there was little reason to believe anything better existed.

However, research has shown that bleached and flavored papers can significantly increase exposure to toxic elements, in some cases contributing more pollutants than the smoking material itself.

Traditional bleached papers contained:

Chlorine compounds that release toxins when burned

Calcium carbonate to slow the burn (but irritating to respiratory systems)

Heavy metals from manufacturing processes and contaminated pulp

Dyes and optical brighteners to achieve that "clean" white appearance

The irony? Papers were being heavily processed and chemically treated to look pure, when natural, unprocessed papers were actually cleaner all along.

The Birth of RAW: One Man's Million-Dollar Gamble

Josh Kesselman's journey to creating RAW began humbly in 1993. Fresh out of the University of Florida, he sold everything he owned to open a tiny smoke shop called Knuckleheads in Gainesville, Florida. After a federal raid in 1996 forced him to refocus his business entirely on rolling papers, Kesselman relocated to Arizona and founded HBI International in 1997. He connected with a rolling paper factory owner in Alcoy, Spain—a region with papermaking traditions dating back to 1764—and created two successful brands: Juicy Jay's and Elements.

But the turning point came in 2004. Kesselman had become convinced that the market needed truly natural, unbleached rolling papers. He found only one supplier who could provide natural, unbleached fiber suitable for "vegan" rolling papers, but there was a catch. The minimum order was $1 million.

But Kesselman believed in his vision. He scraped together the investment and placed the order.

When RAW Rolling Papers launched in 2005, it wasn't positioned as a premium luxury brand—it was a rejection of unnecessary processing. The papers were unbleached, minimally processed, and free from additives used purely for appearance or burn manipulation. RAW became the first company to offer "vegan" unbleached rolling papers made from natural plant fibers with no chemicals, additives, or dyes. The natural brown color that other manufacturers tried to bleach away became RAW's signature.

RAW rolling papers looked different, tasted different, and behaved differently. The paper no longer competed with the material being smoked. For the first time, rolling papers were being evaluated not just on usability, but on what they were made of, and what they weren't.

The Genesis of RAW Cones

As RAW rolling papers gained popularity, a familiar problem resurfaced: people loved the paper, but many still disliked rolling. Rolling remained a skill-based barrier, especially for new smokers and social settings.

RAW Cones emerged as a response to that tension.

Rather than inventing a new concept, RAW refined an existing one. By applying its unbleached rolling paper to a pre-shaped cone, RAW removed the most frustrating part of the process without altering the integrity of the smoke. The same fibers. The same natural gum. The same criss-cross watermark designed to promote an even, slow burn.

RAW Cones weren’t about shortcuts. They were about removing friction. They made cones and rolling papers work together in a way that preserved quality while expanding accessibility.

Cultural Impact and Industry Disruption

RAW's success wasn't immediate—it required a cultural shift. Around 2008, hip-hop artists began discovering RAW and sharing it with their communities. Wiz Khalifa famously dedicated a song to the brand titled "Raw" and later partnered with RAW to release his own line in 2014. Other artists like Curren$y, 2 Chainz, and Mick Jenkins also endorsed the brand, amplifying RAW's message to millions.

The timing was perfect. Consumers were increasingly looking for healthier, more natural smoking experiences. RAW's message of purity and quality resonated with a generation becoming more conscious about what they put in their bodies.

How RAW Cones Redefined the Category

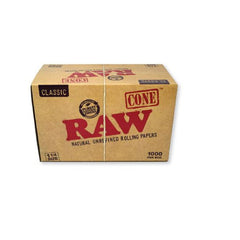

As cannabis markets expanded, the impact of RAW Cones became increasingly clear. Consistency mattered more than ever, especially for pre-roll production. RAW Cones allowed manufacturers and dispensaries to scale without sacrificing burn quality or material efficiency. Over time, cones became foundational infrastructure rather than novelty items.

RAW didn't just compete in the category, it also redefined it. Natural, unbleached cones were no longer a fringe preference; they became the benchmark. Competing brands followed with their own versions, but the standard had already been set. Cones and rolling papers were no longer judged solely on convenience, but on material integrity and performance.

The disruption became undeniable when:

High Times Magazine included RAW Black papers on their list of best rolling papers (2017)

Esquire added RAW to their best rolling papers list (2022)

During the COVID-19 pandemic, demand for RAW products tripled

By 2025, RAW became recognized as the #1 biggest brand in the rolling paper industry

In 2025, actor Timothée Chalamet and rapper EsDeeKid released "4 RAWS (Remix)" with the lyric "Every time I smoke, I light 4 RAWs," garnering over 115 million views on X

From Technique to Experience: A Cultural Transformation

Culturally, RAW Cones changed who could participate confidently in smoking. The focus moved away from rolling skill and toward the shared experience itself. Beginners could contribute. Groups could prepare ahead. Sessions became less about execution and more about intention.

What was once dismissed as "lazy" gradually became normalized, and eventually preferred. RAW Cones proved that ease didn't mean lower quality. With RAW, convenience and craftsmanship finally aligned.

RAW's broader philosophy reinforced this shift. The brand's emphasis on transparency, simplicity, and community resonated with smokers who wanted to be more conscious about what they used. Cones and rolling papers stopped being invisible accessories and became part of a larger conversation about materials, values, and experience.

FREQUENTLY ASKED QUESTIONS

What are RAW Cones made of?RAW Cones are made from unbleached, natural plant fibers and use natural gum, with no added chalk, dyes, or chemical fillers.

Why did RAW Cones become so popular?RAW Cones gained popularity because they combined the convenience of pre-rolled cones with the same natural materials and slow, even burn found in RAW rolling papers.

What’s the difference between cones and rolling papers?Rolling papers require manual rolling, while cones are pre-shaped. RAW Cones remove the rolling step while preserving the same paper quality and smoking experience.

Did RAW invent pre-rolled cones?No. Pre-rolled cones existed before RAW, but RAW refined the concept by pairing cones with unbleached, additive-free rolling paper and consistent burn technology.

Are RAW Cones better than regular rolling papers?It depends on preference. RAW rolling papers offer full control for those who enjoy rolling, while RAW Cones offer consistency and ease without sacrificing paper quality.

What RAW Cones Stand For Today

Today, RAW Cones represent more than a format. They represent a shift in expectations. Natural materials are assumed. Even burns are expected. Consistency is no longer a bonus, but the baseline.

RAW didn’t invent cones, and it didn’t invent rolling papers. What it did was connect them through a philosophy that valued restraint over enhancement. By doing less to the paper, RAW changed how cones and rolling papers are evaluated across the industry.

From that first $1 million order in 2004 to becoming the most recognized rolling paper brand worldwide, RAW proved that sometimes the most innovative solution is to strip away the artificial and return to what's natural. In doing so, they didn't just create a product—they sparked a movement that changed smoking culture forever.